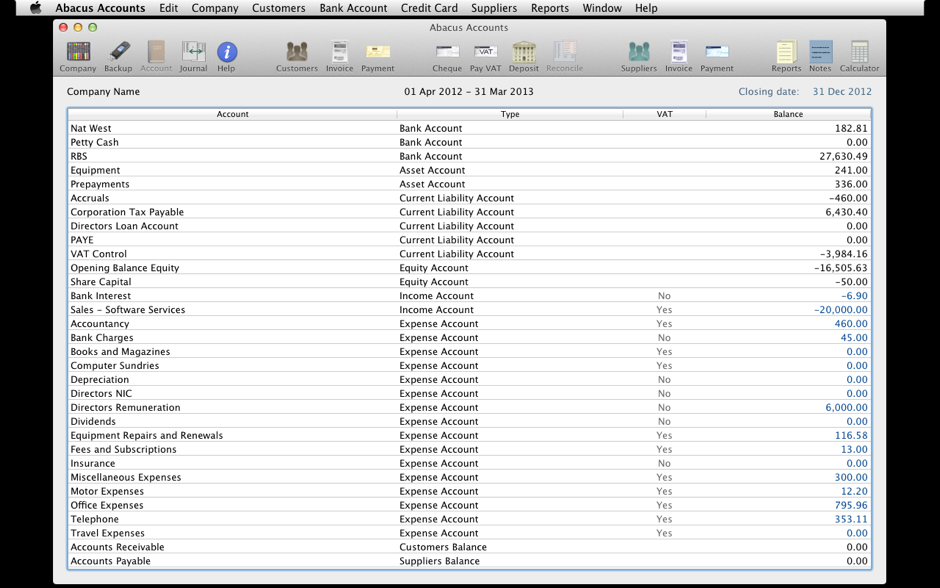

Abacus Accounts is a double-entry bookkeeping application, suitable for any business or company accounts. It is powerful, but easy to use. Various types of accounts can be set up, to suit your business. It can be used by VAT registered or non-registered businesses.

Selections are made using clearly labelled buttons or menu options, whilst transaction entries are made through popup panels, which present the user with the required data fields.

It supports accounts for up to 10 companies/businesses, simultaneously.

You can also set up regular (monthly) payments from any bank account.You are also able to create and print (or email) customer invoices, using your own logo as a header.

The essential bookkeeping requirements are covered, such as viewing account registers, reconciling bank accounts, tracking customer/supplier balances, VAT (or GST/HST/Tax), if required, and end of year reports (see below).

Should you have specific requirements or questions, please contact us, using the link below.

The program is flexible enough to be used worldwide, as VAT / GST / HST / Tax rates can be customised. However, it was designed with the aim of being very quick and easy to use. If you are running a business and want to do your own bookkeeping, this program should meet your requirements.

Although it helps to have some previous bookkeeping experience, a detailed description of how to use the application is included in the help pages.

Technical support is also available by email, free of charge.

Some of the features:

-

★ Easy to use double-entry accounting package.

-

★ Supports Multiple Companies (up to 10).

-

★ Currency symbol, decimal point and ‘thousands’ separator are selectable to suit your country.

-

★ Chart of accounts defined by the user (including bank accounts, credit card accounts, asset, liability, equity, income and expense accounts).

-

★ Track bank accounts, credit cards, income, expense, assets, depreciation, liabilities etc..

-

★ Ability to delete (void) or edit transactions.

-

★ Enter customer and supplier invoices/credit notes.

-

★ Track customer and supplier payments/balances.

-

★ Protect entries using a 'Closing date'.

-

★ Reconcile bank accounts/credit cards.

-

★ Recurring (monthly) transactions.

-

★ Journal entries.

-

★ VAT / Tax calculated automatically, based on rate defined.

-

★ Supports VAT Flat Rate scheme.

-

★ Comprehensive Reports (see below).

-

★ Export reports to CSV files.

-

★ Print (or email) customer invoices/credit notes (using your own logo or headed paper).

-

★ Backup and Restore function.

-

★ Detailed Help pages (including video screencasts).

-

★ Fast email support.

Reports:

-

★ Balance Sheet (2 alternative formats)

-

★ Profit & Loss

-

★ Trial Balance

-

★ All / Selected Accounts

-

★ Debtors / Creditors

-

★ Customer / Supplier Report

-

★ VAT Report / VAT Detailed Report (Accrual or Cash basis)

-

★ Journals Report

-

★ Cash Flow Report

To purchase, please visit the Mac App Store ‘Finance’ section.

Requirements: Mac OS X 10.6 (Snow Leopard) or later.